Astris Advisory Investment Research Best-in-class Japanese Equities and Commodities Research

Our Recent Research

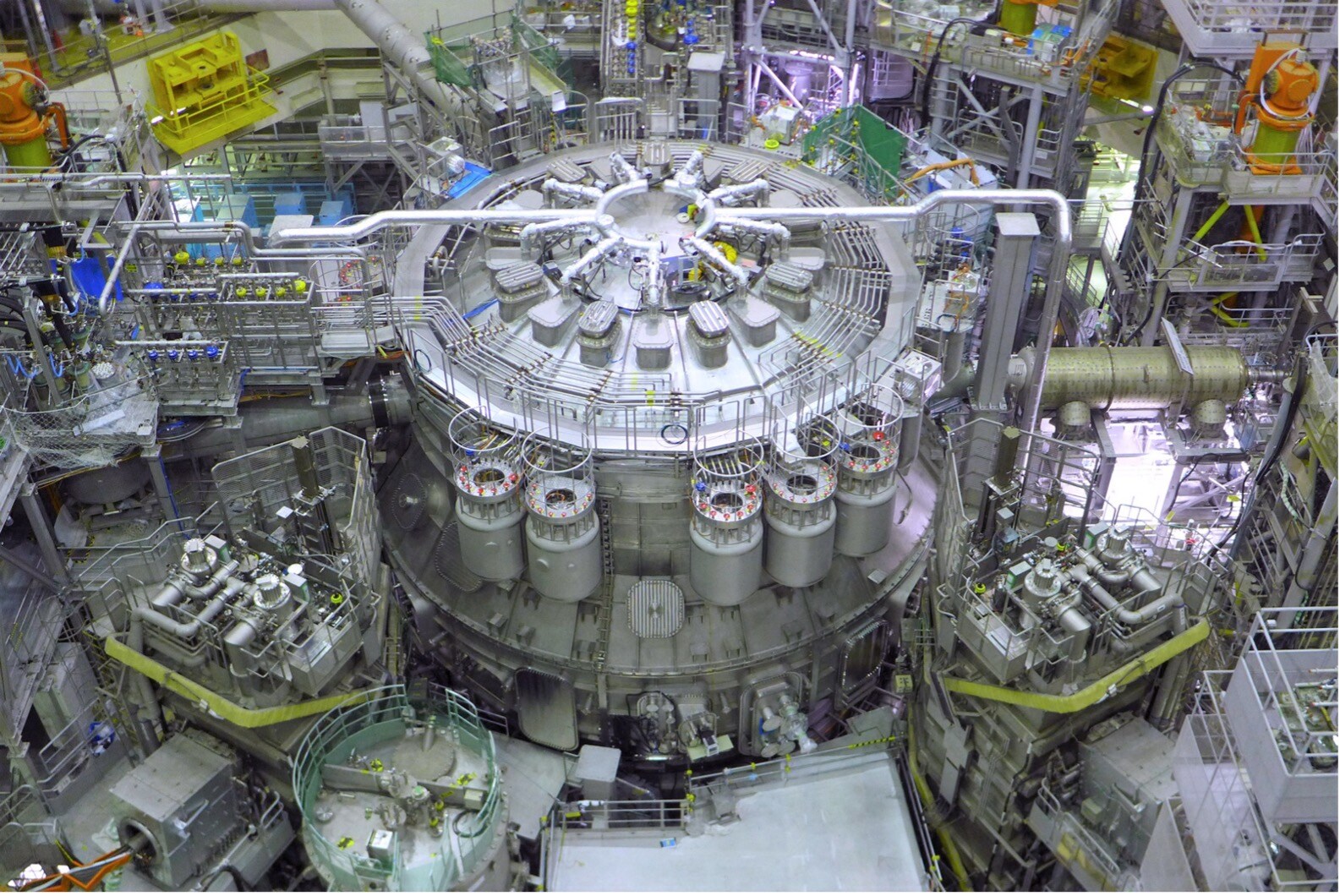

Japan Strategy – New Nuclear becomes a national priority

Neil Newman | 16 Dec 2025

• METI’s 7th Strategic Energy Plan signals a clear shift, highlighting Japan’s increased openness to a stronger long-term commitment to nuclear power. • Slow development timelines and high costs associated with other energy alternatives mean nuclear must play a larger role, and sooner than previously anticipated. • Restarting aging reactors is becoming less attractive, while the development of small modular reactors (SMRs) and nuclear fusion is expanding the scope and applications of “New Nuclear.”

Behind in EVs, decarbonization and data centres, nuclear is coming back

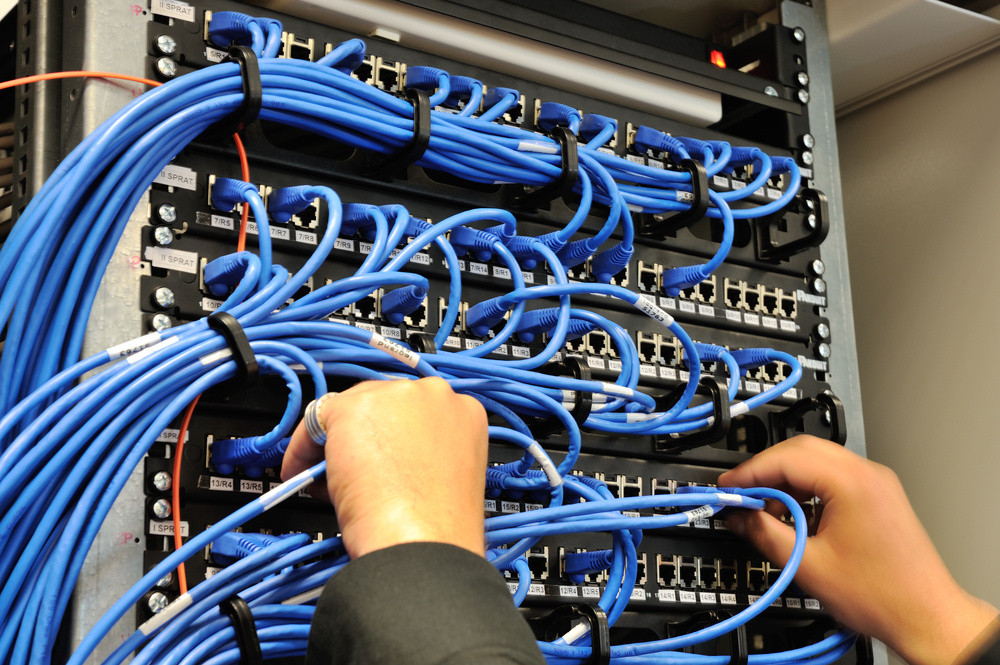

Japan Strategy – If AI blows up, Japan is left holding the baby

Neil Newman | 13 Nov 2025

• Japan has committed to investing in U.S. data centres as part of its US$500bn tariff, avoidance strategy; the first US$30bn is now earmarked. • As with the dot-com start-ups, finding a route to monetisation of AI services is proving difficult. AI tools are free or very inexpensive, while the hardware is extremely costly. • AI and semiconductor stocks are showing bubbly valuations, and, as with every IT revolution, the volume of hardware being consumed is astounding‚ Until the bubble bursts.

When the dot-com bubble burst, U.S. paid the bill. This time, it's different.

VIDEO: Visit to Tokyo Mobility Show 2025

Neil Newman | 06 Nov 2025

A surprising amount of hydrogen at the show, new concepts, some excellent new car designs and a flying taxi.

A visit to the Tokyo Mobility Show 2025

Japan Strategy: New Targets for Nikkei 225 and Topix

Neil Newman | 30 Oct 2025

• Nikkei 225: My ¥51,500 target has been hit (¥51,547 today), clearing the way for a further rally through 2025 ¥56,650, in 2026 to ¥66,500 and I am lifting the terminal target to ¥70,850 in 2027.

New Targets for Nikkei 225 and TOPIX

Japan Strategy: Monday, the LDP will have a different face

Neil Newman | 03 Oct 2025

• The Liberal Democratic Party elects a new president this weekend. The two frontrunners are Sanae Takaichi and Shinjiro Koizumi. • Internationally, this election will be closely watched for signs of political reform and whether the LDP can deliver long-overdue change to the electorate. • For investors, sectoral reforms and new investment could create opportunities, the biggest potentially could be a LDP showdown with the Agricultural Coops.

Most likely outcomes are either a female prime minister or a young reformist.

Japan Strategy - Crypto Comes Back

Neil Newman | 23 Sep 2025

• Policy tailwinds: The U.S. is leaning on stablecoins to reinforce dollar demand and Treasury markets. Japan is watching closely. • Strategic implications: A new parallel system may weaken central bank independence and redefine monetary sovereignty. • Japan’s opportunity: Revised legislation allows yen- and dollar-backed stablecoins, potentially making Tokyo a key regional hub.

After a hiatus of interest, White House fascination with crypto could rub off on Japan.

Japan Strategy - Where Do We Go From Here (September 2025)

Neil Newman | 05 Sep 2025

• Nikkei 225 target for mid 2026 at ¥51,500 +22.5%, Topix 3,800 +25%, terminal target of over ¥60,000 in FY2027. • USDJPY target ¥130 end of 2025, then an average of approximately ¥125 through 2027, perhaps it move in a range ¥110-¥130 • Positioning for the rest of 2025 and into 2026, Long: Defence, Energy, AI/Semiconductors, Short: Food/Consumption, Financials and Tourism plays.

Record highs in equities, Japan becomes an oasis for investors in Asia.

Japan Strategy – Bring the Boys Back Home

Neil Newman | 19 Aug 2025

• As of now, the United States has not formally announced plans to withdraw troops from Japan or South Korea, but strategic discussions are intensifying. • Japan currently hosts around 50,000 U.S. troops, with 26,000 in Okinawa, just 800 km from China, placing U.S. assets within reach in the event of conflict. • If U.S. defence becomes more of an on-demand service, rather than a stationed presence, the region’s self-reliant defence capabilities will inevitably expand. Image Credit: Captures via Telegram / Voennaya Khronika

A troop draw-down in Japan may be the next catalyst for defence stocks

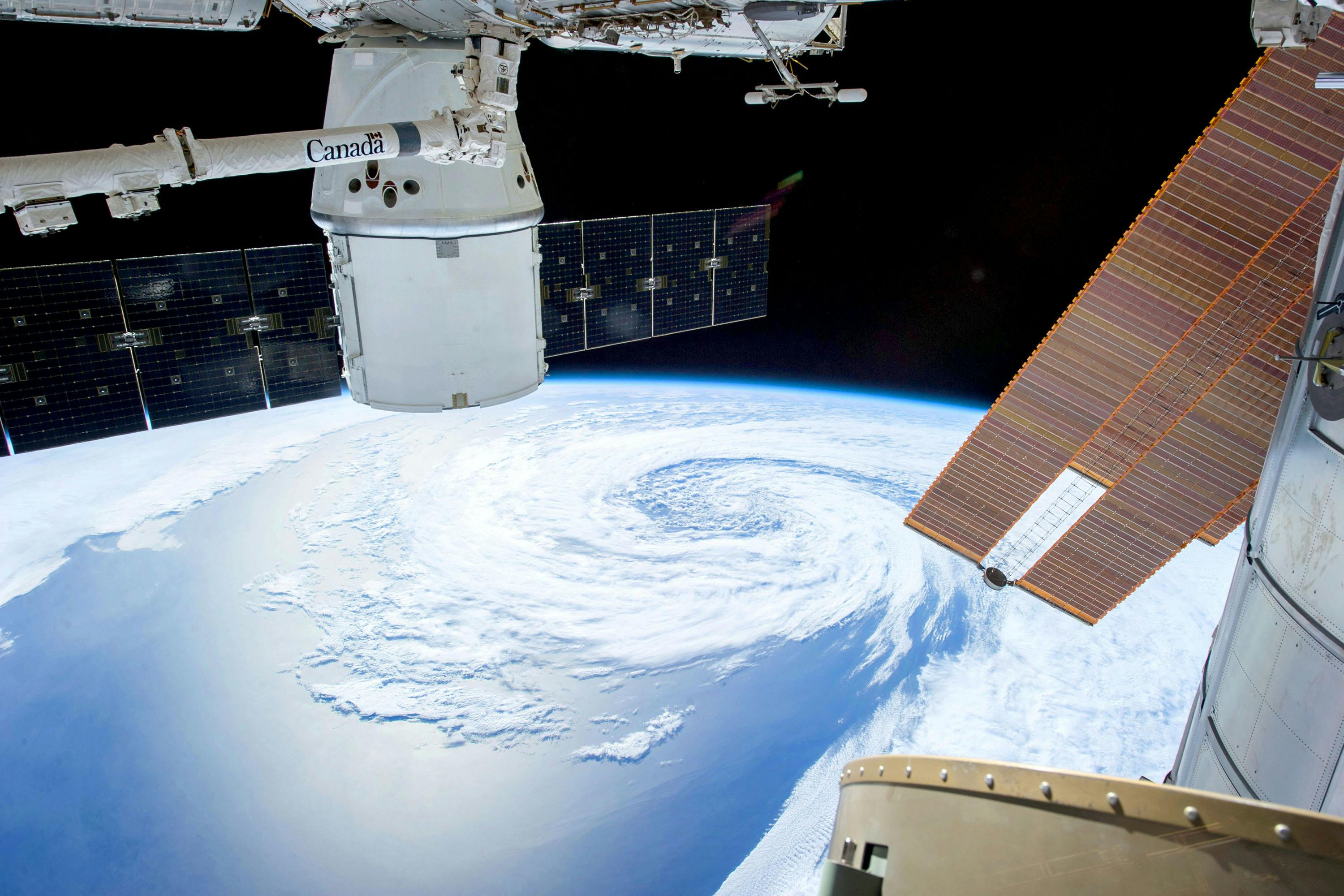

VIDEO: Visit to SPEXA 2025

Neil Newman | 07 Aug 2025

In it's second year SPEXA 2025 is Japan's dedicated trade show for space businesses.

Here is a short video of my visit to SPEXA 2025.

Japan Strategy: Unmasking Beneficial Owners

Neil Newman | 28 Jul 2025

• Japan aims to establish a legal framework to identify beneficial shareholders holding less than 5% stakes via custodian banks. • The Minister of Justice has asked the Legislative Council to review the Companies Act, with reforms anticipated in 2026. • Proposed rules require disclosure of beneficial owners, with voting rights suspended for noncompliance, providing early visibility to stealth activists.

Major legal reforms for full Beneficial Shareholder disclosure in 2026

Japan Strategy – Sold in May and Went Away? Buy in June as the Markets Bloom

Neil Newman | 30 Jun 2025

• Japanese investors firmly believe in chart patterns. And for good reason: they invented them. These patterns form the basis of stock selection in Japan. • Price and emotion-based trading signals found in candlestick charts originated in the mid-1700s, thanks to a legendary rice trader in Osaka. • An inverse head-and-shoulders pattern and a golden cross on the Nikkei 225 suggests we may be entering a new bull phase, with a potential 19% leg higher to ~¥45,000 and possibly more on the Topix.

Equity trading activity in May and June may have changed everything.

VIDEO: Visit to 2025 Japan Energy Summit

Neil Newman | 27 Jun 2025

There was strong representation of LNG and hydrogen technologies from Japan Organization for Metals and Energy Security (JOGMEC) and JERA, the merged power divisions of Tokyo Electric Power Co. and Chubu Electric Power.

Here is a short video report on a visit to a energy trade show held alongside the 2025 Japan Energy Summit, an annual international event showcasing new technologies and the work of key Japanese energy players.

VIDEO: Visit to Japan Drone 2025

Neil Newman | 19 Jun 2025

Visiting the booths of the show to see the latest technology and what Japanese manufacturers are currently offering.

Japan Drone is the only international exhibition and conference annually held in Japan featuring drones (UAS) and its market.

Japan Strategy: Japan’s Commercial Drone Industry Takes Flight

Neil Newman | 19 Jun 2025

• As Japan grapples with an aging population, commercial drones are becoming a critical part of the nation’s evolving workforce. • Having missed out on the consumer drone boom a decade ago to the Chinese, Japan has been playing catch-up in airframes, components, and more recently, large heavy drones. • The drone attack by Ukraine on Russian airbases was an eye-opener, not just for that specific operation, but for how commercial drone technology is being militarised.

The distinction between commercial and military drones is becoming increasingly blurred

Japan Strategy – USDJPY could head into the 120s this year

Neil Newman | 11 Jun 2025

• Nikkei and Bloomberg have both highlighted a punchy call from Nomura’s FX strategy team: the yen is projected to strengthen to ¥136 (a 6% gain) by the end of Q3 based on fundamental asset shift. • The U.S. Treasury has urged the Bank of Japan (BoJ) to continue hiking interest rates, pushing the yen in that very direction, dovetailing with the stance of both the BoJ and Ministry of Finance (MoF) and expectations of a stronger yen. • Trade negotiators from the U.S. and Japan have downplayed currency discussions, but the Treasury and BoJ have not. The catalyst is the successful conclusion of trade negotiations and the G7 meeting next week.

Yen weakness and Japan-U.S. trade talks are linked

Softbank Corp (9434)

Kirk Boodry | 06 Jun 2025

We met with Softbank Corp to catch up on Q4 results and the outlook for FY25.

Follow up after Q4 results and model update

Toyota Motor (7203 JP)

Takaki Nakanishi | 03 Jun 2025

Toyota Industries (TICO) has accepted a proposed buyout by a holding company which will be established by Toyota Real Estate, and officially announced that it will delist from the stock exchange. This is an important development that will solve the company's management issues and promote transparency in Toyota Group's governance. We recognized the negative risk that the handling of TICO's 9% stake in Toyota and the scheme for Toyota's investment in the holding company could have had on Toyota's valuation.

The delisting scheme for TICO will dramatically unwind group crossholdings

Herd On the Street – Japanese Equity Short Report

Neil Newman / Michael Brodie-Brown | 03 Jun 2025

Recommendations – Short Sell Nomura (8604), RED FLAGS on Japan’s top three megabanks MUFG (8306), SMFG (8316), Mizuho Financial Group (8411)

Crowded Financials: Positions in Japan’s Financials Have Ballooned

Toyota Motor (7203 JP)

Takaki Nakanishi | 02 Jun 2025

In late May, Toyota held an Intelligent Technologies Conference at its Higashi-Fuji Technical Center, where it presented the core technologies and demonstrated applications it is developing as part of its SDV strategy. The company has further refined its roadmap for expanding the SDV value chain and achieving a 20% ROE. As an AI company, Toyota will collaborate with industries surrounding mobility to generate profits in the SDV value chain.

SDV strategy analysis in Intelligent Technologies Conference

Internet Initiative Japan (3774)

Kirk Boodry | 02 Jun 2025

IIJ exited FY24 with renewed strength in corporate DX revenue even as 2 June 2025 concerns over VMWare repricing and an April email breach fade. That is reflected in management guidance which met consensus and Astris Japan / Telecoms expectations for high single-digit revenue growth and a return to OPMs BUY above 10%. We have tweaked our model after talking with the company about the FY25 outlook although our forecasts and valuation are largely Kirk Boodry unchanged. With 28% upside to our target price, we remain at Buy. +81 3 6868 8785 boodry@astrisadvisory.com

Follow-up after year-end results

Japan Strategy: Escalate to De-escalate to Negotiate

Neil Newman | 02 Jun 2025

Japan mirrors U.S. transactional trade tactics, using firm but non-confrontational strategies to protect domestic interests while leveraging U.S. priorities. • Trade negotiations now encompass defence, space, and energy collaboration, tying military spending, economic alignment and industrial partnerships to tariff relief. • Japan’s deliberate, unhurried approach prioritises long-term stability, using structured proposals to defend key sectors like autos, steel, and currency policy.

Perhaps Japan is giving the U.S. a taste of its own medicine

NTT (9432)

Kirk Boodry | 29 May 2025

NTT has confirmed reports that came out overnight that it would buy a majority stake in SBI Sumishin Net Bank and invest separately in parent company SBI Holdings. Headline pricing of ¥4,900/share is a 49% premium to the pre-deal close but that applies only to the public float and the blended price/share is closer to ¥4,230 (+29% premium). All in, DoCoMo will spend ¥420bn for 65% of the online bank although its voting rights will be 50% alongside strategic investor SMBC. The deal fills out DoCoMo’s fintech portfolio sooner rather than later and is somewhat surprising as we thought the NTT Data buyout earlier this month and DoCoMo comments in February had taken an acquisition off the table. But the size of the deal is manageable and a faster time-to-market is positive. We remain at Buy.

SBI Sumishin deal price is better than headlines suggest

Japan Auto OEM/OE Supplier Sectors

Takaki Nakanishi | 27 May 2025

This note provides a detailed review of the fundamentals of the OEM sector under the tariffs. We also reviewed specific measures taken by individual companies. We believe that the G7 summit to be held on June 15 is likely to produce some agreement on US-Japan tariff negotiations.

Reassessing fundamentals under the tariffs: Denso looks attractive

Softbank Group (9984 JP)

Kirk Boodry | 27 May 2025

A rebound in ARM’s valuation eases some of the NAV pressure.

Update for Q4 results: $1.4bn more in semi exposure

VIDEO: Visit to Defence and Security Equipment International (DSEI)

Neil Newman | 27 May 2025

Japan is rapidly expanding its defence capabilities, exports, and partnerships amid rising regional threats. • Domestic and international interest in Japanese defence technology is growing, with SMEs playing an increasing role • DSEI Japan 2025 highlights Tokyo’s strategic pivot toward greater military autonomy and industry reform.

DSEI Japan is a biannual, fully integrated defence exhibition serving the international defence community with a focus on Indo-Pacific security.

DSEI 2025 – A Serious Show of Force

Neil Newman | 27 May 2025

Japan is rapidly expanding its defence capabilities, exports, and partnerships amid rising regional threats. • Domestic and international interest in Japanese defence technology is growing, with SMEs playing an increasing role • DSEI Japan 2025 highlights Tokyo’s strategic pivot toward greater military autonomy and industry reform.

Rapid Growth in the Expo Reflects Rising Defence Budgets and Security Concern

Japan Equity Strategy – Greece is the way we are feeling

Neil Newman | 19 May 2025

Yet, Japan has no National Debt

Japan has the highest gross debt-to-GDP ratio of any country, and has been compared with Greece and the US by the ”one model fits all” debt-rating agencies. As interest rates rise, the cost of servicing debt goes up… or does it really, when most of government debt is owned by government pension funds and the central bank? Rumblings of a sovereign debt downgrade have started, but before anything like that happens, there needs to be a fresh look at Japan’s debt burden.

Japan Strategy - Biofuel Boost

Neil Newman | 14 May 2025

Japan Strategy: Auto Tariffs, Japan Counters with Corn

Auto tariffs remain a major hurdle in Japan-U.S. trade talks, but partial U.S. exemptions elsewhere suggest tariffs are up for negotiation. Japan plans to increase U.S. corn imports, not for food but for ethanol production, aligning with its national energy strategy. Japan’s biofuel roadmap targets E10 by 2030 and E20 by 2040, with nearly all ethanol currently imported from the U.S., could be accelerated if Japan makes its own.

KDDI (9433)

Kirk Boodry | 14 May 2025

Q4 24 results flash: beat

The Matsuda era has arrived. In the first results meeting presided over by new CEO Hiromichi Matsuda, KDDI posted Q4 results and FY25 guidance that was largely in-line with expectations supported by plans for shareholder returns that were much more generous than we expected. Operationally, mobile service has returned to growth whilst corporate DX sales have improved as IoT growth offsets BPO weakness. This is a good quarter with a great returns story. We remain at Buy.

Rakuten Group (4755)

Kirk Boodry | 14 May 2025

Q1 25 results flash: mixed

These were uninspiring results. Q4 revenue was in line, helped by a solid beat for Rakuten Bank but that was offset by a dip in form for the mobile business after its star turn in Q4 whilst eCommerce growth also came in weaker than expected. The company does not expect any direct impact from new tariff policies out of the US but there are indirect impacts to overseas ad sales, Kobo device exports and the Rakuten Rewards business that could slow non-core growth. Shares have largely traded flat in 2025 but are down 14% from recent highs in February. We think the stock is fairly priced and remain at Neutral.

Herd On the Street – Japanese Equity Short Report

Neil Newman / Michael Brodie-Brown | 14 May 2025

May 2025: The effect of rising food inflation

We are negative on consumer spending and concerned about frugality on food, beverage manufacturers and general household spending going into the early summer.

Subaru (7270 JP)

Takaki Nakanishi | 14 May 2025

Due to uncertainty surrounding the impact of tariffs, SUBARU refrained 14 May 2025 from announcing earnings guidance. The dividend plan of ¥115 per share limits downside risk of the share price, but we believe substantial Japan / Auto OEM improvement in tariff conditions is necessary for any reversal. SUBARU NEUTRAL announced a policy to defend its unit sales and market share despite the tariff burden and aims to achieve a recovery even if profit levels are Takaki Nakanishi depressed in the short term. The company indicated that ¥100 bn OP is +81 90-2212-8853 the last line of defence for the current fiscal year. nakanishi@astrisadvisory.com

4Q earnings flash: In-line

IIJ (3774)

Kirk Boodry | 13 May 2025

Q4 24 results flash: in-line

IIJ posted results and guidance that were largely in line with consensus and Astris expectations. Q4 revenue was ahead of target on a robust order book for system integration even as recurring revenue growth stepped up from Q3. Corresponding operating profit and EBITDA for the quarter came in weaker than we expected but the outlook for FY25 is better and indicates the company is back on a growth track after VMWare pricing issues last year. We remain at Buy.

Softbank Group (9984)

Kirk Boodry | 13 May 2025

Q4 24 results flash: steady

Since the end of March, concerns had been building about Softbank’s tech portfolio and its ability to fund new AI investments but the recent rebound market rally, culminating in a 4.4% gain for NASDAQ overnight, has taken some of the pressure off. The two main takeaways for us were 1) the surprise Q4 profit balanced by 2) a lack of clarity on progress at Stargate and with the Cristal sales venture in Japan. Outside of that, the company re-iterated its financial guardrail policy and said that markets have been receptive to funding Softbank’s AI investments so far, which is positive whilst establishment of a robotics holding company is intriguing. We remain at Buy.

Nissan Motor (7201 JP)

Takaki Nakanishi | 13 May 2025

Lack of speed. To our eyes, with high expectations for CEO Espinoza's 13 May 2025 decision-making ability and speed, the plan seemed typical of Nissan. We strongly commend the new executive team for bringing Japan / Auto OEM additional restructuring measures to a decision just one month after NEUTRAL taking office. Nevertheless, we felt that the plan lacked exciting developments for the new Nissan. We wonder if the timeline for Takaki Nakanishi FY3/28 is a little too lengthy. +81 90-2212-8853 nakanishi@astrisadvisory.com

4Q Results Flash: Negative

Yamaha Motor (7272 JP)

Takaki Nakanishi | 13 May 2025

The outboard motor business has become tougher than expected. 13 May 2025 Canadian competitor Brunswick announced a significant downward revision of its earnings forecast due to tariffs and weak demand. We Japan / Auto OEM recognize the risk that the downturn in the US leisure goods market NEUTRAL affected by tariffs will have a material impact on Yamaha Motor. Takaki Nakanishi

1Q Results Flash: Negative

Suzuki (7269 JP)

Takaki Nakanishi | 12 May 2025

Suzuki taking a prudent stance in announcing its company plan for the 12 May 2025 new fiscal year. We believe that there is considerable upside potential as the company will be able to achieve earnings close to our estimates. Japan / Auto OEM Suzuki reaffirmed that the impact of tariffs will be quite minimal. BUY Although domestic demand in India remains sluggish, the company's strategy of making India an export base is proving a success, and it Takaki Nakanishi expects exports from India to grow substantially from 330k units in +81 90-2212-8853 the previous period to 400k units in FY3/26. nakanishi@astrisadvisory.com

4Q Earnings Flash: In-line

Mazda Motor (7261 JP)

Takaki Nakanishi | 12 May 2025

We anticipated that it would be difficult for Mazda to present earnings 12 May 2025 and dividend estimates at this stage, and we are not surprised that the company has left its plans undecided. Details will likely be Japan / Auto OEM announced in the 1Q results. Mazda has reemphasized its plan to NEUTRAL strengthen its earnings structure by cutting fixed costs by ¥100.0bn and variable costs by ¥100.0bn toward FY3/27. Takaki Nakanishi +81 90-2212-8853

4Q Results Flash: In-line

NTT (9432)

Kirk Boodry | 09 May 2025

Q4 24 results flash: mixed

NTT has posted financial results for Q4 that missed expectations whilst FY25 guidance is also weaker than expected despite the financial boost from data center sales at NTT Data announced yesterday. NTT also announced a ¥200bn share buyback to reassure investors that the policy on shareholder returns hasn’t changed despite its NTT Data announcement yesterday. We would have liked to see a larger step up in profitability but a return to YoY growth with room to invest in the business is also positive. We remain at Buy.

Softbank Group (9984)

Kirk Boodry | 08 May 2025

ARM read-across: guidance stumble on murky outlook

ARM posted solid Q4 results but guidance for Q1 was not as strong whilst the company did not provide full-year targets as its customers are uncertain about how actual sales will progress this year. Management remains bullish on long-term prospects as ARM-based chips represent 50% of shipments to hyperscalers whilst the outlook for growth in higher-royalty CSS sales remains positive. ARM shares fell 10% in late trading after the print but we think the overall message was better than that.

NTT (9432)

Kirk Boodry | 08 May 2025

NTT Data acquisition confirmed

NTT has confirmed it will tender for the 42% of NTT Data it does not own at ¥4,000/share, a 34% premium to the pre-deal price and a 23% premium to the all-time high reached earlier this year. As we discussed before, we believe the deal makes sense strategically although the transaction is dilutive to our NTT target price by c. 3% or ¥6/NTT share as it is priced higher than the ¥3,200 value for NTT Data implied in our NTT model. We are lowering our target price from ¥207 to ¥201 and remain at Buy.

Softbank Corp (9434)

Kirk Boodry | 08 May 2025

Q4 24 results flash: in-line

Softbank Corp posted Q4 results ahead of forecasts but guidance for FY25 is a touch below our expectations, largely on accelerated AI and R&D investment. Telecom operations continue to deliver with growth rates for consumer mobile and corporate business solutions steady QoQ. This was a solid quarter but a 12% YTD jump in the share price indicates much of that upside is built in already and we remain at Neutral.

Mitsubishi Motors (7211 JP)

Takaki Nakanishi | 08 May 2025

The company plan has factored in a relatively realistic impact of tariffs 08 May 2025 on earnings. However, sales volume assumptions appear optimistic in each region, and we believe that substantial challenges remain to be Japan / Auto OEM overcome. The update of KPIs in the medium-term business plan, NEUTRAL “Challenge 2025,” revealed significant miscalculations in sales volume and profit plans. We recognize that the improvement of product Takaki Nakanishi competitiveness is a significant achievement. The challenge of building +81 90-2212-8853 a sustainable earnings base will be left to the next medium-term nakanishi@astrisadvisory.com business plan.

4Q Results Flash: In-line

Toyota Motor (7203 JP)

Takaki Nakanishi | 08 May 2025

Toyota conducted an interim assessment of the two years under the 08 May 2025 Sato leadership and implemented comprehensive strategy updates for the future. Toyota will promote a fundamental change in how it makes Japan / Auto OEM money. Although tariffs will have a negative impact on short-term BUY earnings, they also provide an opportunity to further refine Toyota's competitive strengths. We recognize that Toyota has reached an Takaki Nakanishi important turning point in its group governance reform. We hope this +81 90-2212-8853 will lead to positive progress for Toyota's corporate value. nakanishi@astrisadvisory.com

4Q Earnings Flash: In-line

LY Corp (4689)

Kirk Boodry | 07 May 2025

Q4 24 results flash: positive

LY Corp posted Q4 results and FY25 guidance that was largely in-line with expectations although we expect headlines will focus more on the ¥150bn buyback and a possible PayPay IPO later this year as preparations for a listing have kicked off. It is still early days as the timing and location (US or Japan) have yet to be confirmed whilst macro issues remain an issue but confidence in the underlying business is deserved. We remain at Buy.

Japan–U.S. Trade: Storm Clouds Begin to Clear

Neil Newman | 02 May 2025

Emerging Agreements Set a Blueprint for Asia—and Potentially the World

Japan is negotiating trade relief, offering concessions in autos, agriculture, and LNG imports, with outcomes likely to influence broader Asia–U.S. trade following Golden Week. Asian nations are using LNG imports and defence procurement, including joint shipbuilding, as strategic tools to ease U.S. tariff pressure, strengthen bilateral security and trade ties. A yen rebound is to be expected, boosting Japanese purchasing power. Investment opportunities may re-emerge in auto, energy, banking, defence, and shipbuilding sectors once trade tensions ease.

Deep Dive: Hydrogen, its a Gas Gas Gas...

Neil Newman | 30 Apr 2025

A deeper look as of 2025 at Hydrogen as a fuel in Japan..

Japan has been developing its use of hydrogen as a fuel, from transport to power generation. This report follows the short video that summarised the main exhibitors at Smart Energy Week focusing on Hydrogen and goes into greater depth on the current level of development of hydrogen as a fuel in Japan.

Toyota Motor (7203 JP)

Takaki Nakanishi | 28 Apr 2025

On April 25, Bloomberg published a scoop article titled “Akio Toyoda 28 Apr 2025 is said to plan record Toyota Industries buyout” followed by a number of media outlets. Toyota and Toyota Industries Corporation (TICO) Japan / Auto OEM issued an official statement that “No decision has been taken at this BUY time”. Although we believe the Bloomberg article contains some inaccuracies, we surmise that the probability of a delisting and buyout Takaki Nakanishi is relatively high. We report our thoughts below. +81 90-2212-8853 nakanishi@astrisadvisory.com

Our thoughts on reports of Delisting of TICO and Toyota's buyout

VIDEO: Visit to Hydrogen & FC Expo

Neil Newman | 26 Apr 2025

A look at the latest in Hydrogen as a fuel.

Japan has been developing its use of hydrogen as a fuel, from transport to power generation. This short video summarises the main exhibitors at Smart Energy Week focusing on Hydrogen. This video will be followed by a deep dive report on the topic.

Sky Perfect JSAT (9412)

Kirk Boodry | 25 Apr 2025

Q4 24 results flash - positive

Sky Perfect posted results that were modestly short of revised guidance for FY24 even as FY25e guidance exceeded expectations with revenue and operating income 2% and 6% ahead of our forecasts respectively. Of particular note is an acceleration in spending with capex budgeted to more than double whilst investors received a punchy dividend increase for the second straight quarter. We raised our targets at the end of March on higher hopes for the space segment but today’s announcement implies that media segment results should come in better too. We remain at Buy.

China domestic drivers should be enough to counter trade slowdown for metals

Ian Roper | 25 Apr 2025

Global uncertainty soars, but China domestic reacceleration on track

After proving relatively robust through the first quarter, even metals prices couldn’t stay immune to the broader risk sell off on the back of Trumps Tariffs. Markets are understandably concerned about how deep a US recession could become and consequent knock-on effects. However China is already well underway in countering the long-expected export slowdown, having begun their stimulus in September last year and accelerated it since the US election in November. With China looking to do what it has done many times in the past two decades, pushing the domestic economy counter to the global/export economy, I still feel the outlook for metals demand remains constructive near term, even if longer term uncertainty has risen. A key risk near term will be currency volatility. Traditionally a weaker US$ is good for metals and for emerging market growth, but China also appears to be trying to push the RMB lower against a weakening US$ to offset some of the tariff measures. While supportive to domestic growth, a weaker RMB has traditionally not been a positive signal for metals prices. Copper, aluminium, zinc, steel and steel raw materials are my order of preference. Nickel and lithium continue to battle against more abundant supply dynamics however so should remain challenged, while thermal coal is equally seeing more than sufficient supply as demand increasingly disappoints from all major markets as renewables generation surges.

Aisin (7259 JP)

Takaki Nakanishi | 25 Apr 2025

Aisin's share price jumped nearly 10% immediately after the 25 Apr 2025 announcement of a large share buyback. This seems to be a slight overreaction given that the buyback represents 17.2% of the total Japan / Auto OEM number of shares outstanding, and we are concerned about a short- BUY term reversal. The company has factored in tariff costs of ¥20.0bn in its profit plan. We believe that the reliability of the figures is low, Takaki Nakanishi but we appreciate the message that the company will be able to +81 90-2212-8853 avoid a decline in profits after factoring in certain risks. nakanishi@astrisadvisory.com

4Q Results Flash: In-line

Denso (6902 JP)

Takaki Nakanishi | 25 Apr 2025

Excluding the impact of tariffs, the company's plan was largely in line with expectations. We believe the issue lies not in tariff costs Japan / Auto OEM but in unit volumes. Much of the tariff costs incurred by suppliers BUY are likely to be passed on to OEMs. On the other hand, substantial downside risks to new vehicle production volumes are emerging Takaki Nakanishi due to rising new vehicle prices, an economic slowdown, and +81 90-2212-8853 deteriorating consumer sentiment, prompting us to recognize investment risks for suppliers. nakanishi@astrisadvisory.com

4Q Earnings Flash: In-line

Softbank Group (9984)

Kirk Boodry | 24 Apr 2025

OpenAI’s new valuation driven by upgraded projections

Softbank Group’s $30bn investment in OpenAI at a post-money $300bn valuation is driven in part by expectations of higher revenue from agentic AI and monetization of the free user base. A report from the Information website (link below) puts FY29 revenue at $125bn, implying a 102% CAGR from 2024 and implying a level of sales that puts the company just outside the Top 50 highest globally on current year comparisons. The company also expects to be free cash flow positive by FY29 (+$12bn) although losses over the next three years could be as much as $46bn.

Japan Strategy – Japan and U.S. Going Into Battle on Trade

Neil Newman | 16 Apr 2025

Trade Talks Are Underway, Driven by Optics and Strategy

Japan–U.S. Trade Strategy: Symbolic Wins and Strategic Optics. Both Japan and the U.S. are approaching the trade talks with political optics in mind. Japan is expected to offer visible concessions—such as increased local production and investment in automation—while the U.S. seeks tangible “wins” to showcase to voters, particularly around trade deficits, job creation, and defence burden-sharing. The negotiations will centre on automobiles, with Japanese manufacturers like Toyota, Honda, and Nissan pledging greater U.S. output. Technology companies, especially in robotics and automation, may benefit from assembly shifts. Japan is also exploring investment in U.S. LNG infrastructure (notably the Alaska project), aiming to secure energy partnerships while reducing Russian dependence. Currency and Defence at the Forefront. The weak yen is expected to become a core issue, with potential agreements around strengthening the currency through Bank of Japan rate hikes. Defence spending and military cooperation will also be in focus, with Japan edging toward its 2% of GDP commitment and facing U.S. pressure to define its strategic role in potential future conflicts involving American forces.

IIJ (3774)

Kirk Boodry | 15 Apr 2025

Cyberattack could impact security revenue

IIJ reports that its corporate email product IIJ Secure MX Service has been hacked, impacting up to 6,493 corporate accounts and 4mn addresses. IIJ is not the first in our coverage to be hit by a cyberattack this year as NTT Group had a similar data breach last month (18K accounts), but it is still not a good look for a cloud/security provider. The company says it first became aware of the issue last week, so it probably does not impact Q4 financial results, although management will need to have a comprehensive update for investors when it reports in May.

Trump, Tariffs and Tokyo

Neil Newman | 09 Apr 2025

How US Trade Policy Negotiations Will Focus on USDJPY

Trump’s tariff calculation hit Japan hard despite existing low tariff barriers with the US, suggesting there is more to the method than meets the eye. Japan will however emerge as a stable, strategic player in an unstable global economy and as an oasis in Asia for foreign investment.Scott Bessent’s appointment signals a focus on yen-dollar dynamics as the negotiating table is dusted off for fist pounding.

Softbank Group (9984)

Kirk Boodry | 04 Apr 2025

Playing with political fire

With a 16% decline for the week, Softbank Group has been among the larger market losers in the wake of the tariff shock coming out of the US. Not only are tech valuations falling but Softbank’s discount to NAV is widening too (55% v 52% on Tuesday) and approaching levels last seen during the mini-meltdown in August last year. There are a couple of issues at play.

SUBARU (7270 JP)

Takaki Nakanishi | 04 Apr 2025

We have factored in some of the impact of the Trump tariffs, 4 Apr 2025 which have now been clarified, into our earnings estimates. As the tariffs on Japan are more severe than those in the USMCA, Japan / Auto OEM contrary to our expectations, we find it difficult to maintain our NEUTRAL BUY rating. We lower our rating to NEUTRAL and recommend waiting for a better opportunity to reinvest. Nevertheless, based Takaki Nakanishi on the shareholder return policy, we anticipate the launch of a +81 90-2212-8853 ¥60bn share buyback at the May earnings announcement. There nakanishi@astrisadvisory.com may be a good trading opportunity if the shares are oversold. Summary of Rating and Target Price

Downgraded to NEUTRAL

Japan Auto OEM/OE Supplier Sectors

Takaki Nakanishi | 04 Apr 2025

The Trump administration announced reciprocal tariffs. 7 Apr 2025 We got the strong impression that the Trump tariff policy is leaning towards a fundamental “industrial policy”. In Japan / Auto OEM/OES the foreseeable future, there would be no major changes, and we believe a substantial impact on the auto industry Takaki Nakanishi is inevitable. The risk of a global recession is increasing. +81 90-2212-8853 It will take some time before night turns to dawn. nakanishi@astrisadvisory.com

Reflecting the impact of the battle in US tariffs on earnings estimates

Japan Auto OEM/OE Supplier Sectors

Takaki Nakanishi | 04 Apr 2025

The Trump administration announced reciprocal tariffs 7 Apr 2025 that exceeded imagination. We gained a strong impression that the Trump tariff policy is leaning towards Japan / Auto OEM/OES a fundamental “industrial policy”. In the foreseeable future, there would be no substantial changes, and we Takaki Nakanishi believe a substantial impact on the auto industry is +81 90-2212-8853 inevitable. It will take some time for an inflection point. nakanishi@astrisadvisory.com

Reflecting the impact of the battle in US tariffs on earnings estimates

Softbank Group (9984)

Kirk Boodry | 01 Apr 2025

A deeper look at OpenAI as the fiscal year ends

Softbank confirmed today everything that we have been hearing regarding an OpenAI investment. There were no last-minute reveals or additions.

Japan fintech

Kirk Boodry | 01 Apr 2025

Cashless payments surpass 40%

Ministry of Economy, Trade, and Industry (METI) data indicates that cashless accounted for 43% of total payments in 2024, up 11% YoY and meeting government targets for hitting 40% by 2025 one year early. Japan continues to lag most other markets in transitioning away from cash but it is closing in on the 50-60% penetration seen in the US and UK. In terms of absolute volumes, credit card usage increased the most but QR code payment apps like PayPay continue to grow faster.

Sky Perfect JSAT (9412)

Kirk Boodry | 31 Mar 2025

IR Day highlights and an update to our model and valuation

We haven’t written as much about Sky Perfect JSAT or even the space business overall as we would have liked but Sky Perfect JSAT’s IR Day gives us an opportunity to rectify that.

Japan Auto OEM Sector Flash

Takaki Nakanishi | 27 Mar 2025

Update on the impact of the Trump auto tariffs We have reviewed the impact of the auto tariffs announced 27 Mar 2025 on March 26 and updated the earnings impact. We had hoped that exemptions or reduced tariffs would be granted Japan / Auto OEM for imports from Japan, so we were disappointed by the imposition of these harsh tariffs. Until the future Takaki Nakanishi implementation becomes clear, this is a strong blow to +81 90-2212-8853 sector performance. The impact of the tariffs is certainly nakanishi@astrisadvisory.com heavy, but we should also focus on the opportunities that will arise from Trump's environmental deregulation. We think there is a chance for a turnaround in sector Operating Profit Sensitivity by Automobile Tariff performance from June onwards.

Japan Auto OEM Sector Flash

Japan Equity Strategy: The Trend is Your Friend

Neil Newman | 21 Mar 2025

The Trend of Rising Ordinary Profits is Firmly Reestablished.

With increased domestic and international demand, a resurgence in inbound tourism, and improving yen exchange rates, Japanese companies are experiencing a renewed trend of rising profits. Small and mid-sized businesses (SMEs) are shifting toward profit growth, raising expectations for wage increases as input costs decline. The trend is your friend. However, Japanese stocks have been stuck in a rut, and investors have yet to capitalize on this momentum.

Rethinking the Fundamentals for FY2025

Takaki Nakanishi | 10 Mar 2025

Nissan following the breakdown of their merger talks, (2) our thoughts on the financial strategies of Subaru and Japan / Auto OEM/OES Suzuki, (3) re-examining the impact of Trump's tariffs, and (4) updating our medium-term financial forecasts. Takaki Nakanishi Although the sector is exposed to severe external risks, it +81 90-2212-8853 is still possible to generate alpha. We maintain our BUY nakanishi@astrisadvisory.com on Toyota, Suzuki, and Subaru. Among the OE suppliers, we prefer Aisin. Summary of Rating and Target Price

This report discusses (1) the outlook for Honda and

Rethinking the Fundamentals for FY2025

Takaki Nakanishi | 10 Mar 2025

Nissan following the breakdown of their merger talks, (2) our thoughts on the financial strategies of Subaru and Japan / Auto OEM/OES Suzuki, (3) re-examining the impact of Trump's tariffs, and (4) updating our medium-term financial forecasts. Takaki Nakanishi Although the sector is exposed to severe external risks, it +81 90-2212-8853 is still possible to generate alpha. We maintain our BUY nakanishi@astrisadvisory.com on Toyota, Suzuki, and Subaru. Among the OE suppliers, we prefer Aisin. Summary of Rating and Target Price

This report discusses (1) the outlook for Honda and

Japan telecoms

Kirk Boodry | 05 Mar 2025

Mercari Mobile: eCommerce is the target

Mercari has launched an MVNO. They are a bit late to the game but Mercari has launched a new consumer-facing mobile service alongside its eCommerce and fintech offerings. The new service can help tie those two offerings together (indeed, payment is through Merpay or Mercard only for now) whilst Mercari uniquely offers users the ability to buy or sell unused data volumes in 1GB increments, tying mobile directly into the C2C commerce platform. Headline pricing of ¥990/2GB and ¥2,390/20GB is roughly competitive with MVNOs like IIJmio, which charges ¥440 for 2GB/data and ¥2,240 for 35GB with incremental (campaign) pricing of ¥500 for voice calling.

Japan Auto OEM Sector Flash

Takaki Nakanishi | 04 Mar 2025

25% tariffs on Canada and Mexico officially launched The stock market reacted relatively calmly to the news of 04 Mar 2025 the official launch of the tariffs. It is likely that the market has already factored in the news and perceives that it would Japan / Auto OEM be difficult to continue the high tariffs for the long term. We completely agree. The next thing to watch is the progress of Takaki Nakanishi reciprocal tariffs and automobile tariffs on April 2. The tariff +81 90-2212-8853 debate will likely heat up in the April-June period. nakanishi@astrisadvisory.com Nevertheless, considering the current state of the US economy, we believe maintaining high tariffs for a long period will be difficult. We are relatively optimistic that the Comparison of production ratios in CY2024 stage should come relatively soon where we can assess the real tariff risk.

Japan Auto OEM Sector Flash

VIDEO: Visit to Smart Energy Week

Neil Newman | 26 Feb 2025

De-carbonization, biomass and wind energy

As Japan is tied into fossil fuels in the energy mix will through the next two decades, there is a growing corporate interest in business involvement in decarbonisation. Using biomass as a fuel source for generating electricity is relatively new, but may become interesting as the excessive amount of pollen shedding cedar trees that are a target for harvesting for energy. And offshore wind-power, seemingly as inaccessible as nuclear fusion, is still on the road to becoming a reality. In this video, Neil Newman visits Smart Energy Week 2025 to find out the latest for Astris Advisory.

Japan Equity Strategy – Artificial Intelligence Going Cheap

Neil Newman | 20 Feb 2025

Hardware, not software, should remain the investor focus.

No matter how cleverly coded software products can be, each evolution of IT tech requires more infrastructure. Why cheap and compact AI from China surprised the market is beyond me. From calculators to Electric Vehicles, it always happens. AI software products remain a solution looking for a problem. Developer share price valuations escalate without making money. So, invest in hardware.

Honda Motor (7267 JP)

Takaki Nakanishi | 20 Feb 2025

In light of changes in environmental regulations, CEO Mibe 20 May 2025 announced a recalibration of the company's automotive electrification strategy in his annual update. The new strategy Japan / Auto OEM focuses on (1) electrification centered on intelligence and (2) a NEUTRAL review of the powertrain portfolio. HEVs equipped with NOA (the next-gen ADAS) are anticipated to support the company's volume Takaki Nakanishi growth and earnings expansion. Over the medium to long term, we +81 90-2212-8853 believe that this decision will lead to a revaluation of Honda's auto nakanishi@astrisadvisory.com business, which has not been given a meaningful enterprise value in the SOTP due to concerns over excessive BEV investment. Valuation and Target Price

2025 Business Update: The battle moves to the realm of intelligence

Suzuki (7269 JP)

Takaki Nakanishi | 20 Feb 2025

The message in Suzuki's new medium-term business plan (MBP) is to 20 Feb 2025 achieve sustainable growth centered on India by continuing aggressive investments while also enhancing financial discipline, and increasing Japan / Auto OEM shareholder returns in a well-balanced manner. The fact that the company BUY has set a target of 13% ROE by FY2030 and 15% in the first half of 2030s, while maintaining appropriate financial leverage, is highly commendable. Takaki Nakanishi We believe that the company's plan is to reduce the negative value in +81 90-2212-8853 the Suzuki stub value (excluding Maruti Suzuki) and to increase its nakanishi@astrisadvisory.com attractiveness as an investment.

Emphasis on growth investments with strong financial discipline

Japan Equity Strategy – Having The Last Word

Neil Newman | 13 Feb 2025

Tariff targets China, Canada, and Mexico; equity markets are up. The US and Japan are down.

Tariff – ‘the most beautiful word in the dictionary.’ China might agree, with the HSI up +8% and CSI 300 +2.69% month-to-date in US$ terms, while the Nikkei 225 is down -1.54% and DJI -0.98%.* President Trump's love of tariffs started when he was a real estate developer, believing Japan was taking advantage of Americans and hindering US businesses. During his second presidency, it is essential to focus on his objectives rather than the tariffs to understand what will happen and where investments should be directed.

Honda Motor (7267 JP)

Takaki Nakanishi | 13 Feb 2025

Even though the negotiations for a merger were terminated, Honda 13 Feb 2025 confirmed that it would continue the ¥1.1tn share buyback program. We appreciate the company's strong financial discipline. The Japan / Auto OEM earnings base supported by the motorcycle business continues to be NEUTRAL robust. On the other hand, with the merger with Nissan not going ahead, Honda now needs to provide an adequate explanation of how Takaki Nakanishi it will be able to achieve its SDV and AD/ADAS strategies. +81 90-2212-8853 nakanishi@astrisadvisory.com

3Q Results Flash: In-Line

Nissan Motor (7201 JP)

Takaki Nakanishi | 13 Feb 2025

Nissan was the same as usual. The restructuring plan did not differ 13 Feb 2025 substantially from the outline presented in November. The speed of management decisions showed no particular change. In aiming for Japan / Auto OEM restructuring by itself, a new alliance is the key to sustainability. NEUTRAL Other than the logic of “new cars will be released”, there were no fresh measures, and we felt that there was a lack of evidence to be Takaki Nakanishi confident about the success of standalone reform. +81 90-2212-8853 nakanishi@astrisadvisory.com

3Q Results Flash: Negative

Honda Motor (7267 JP)

Takaki Nakanishi | 13 Feb 2025

Even if assuming the worst-case scenario, issuing extremely low 13 May 2025 guidance risks causing misunderstanding in the market, and we cannot agree with this policy. Honda's bad habit of causing “Honda Japan / Auto OEM shocks” in its stock price with its earnings announcements has NEUTRAL returned. A short-term negative impact on the stock price is unavoidable, but we do not believe that the intrinsic enterprise value Takaki Nakanishi has been damaged. The stock price correction could be an +81 90-2212-8853 opportunity to re-enter. nakanishi@astrisadvisory.com

4Q Results Flash: Negative

Japan Auto OEM Sector

Takaki Nakanishi | 13 Feb 2025

“Honda/Nissan's merger talks collapse” - Thoughts on future developments Honda and Nissan officially terminated the Memorandum of 13 February 2025 Understanding (MOU) for the merger. The termination itself was not a surprise, as there had been media speculation on February 5th. We Japan / Auto OEM summarize the truth behind the breakup at the press conference and examine the future developments. Takaki Nakanishi +81 90-2212-8853

Japan Auto OEM Sector

Yamaha Motor (7272 JP)

Takaki Nakanishi | 12 Feb 2025

After the announcement, the share price fell by more than 5%. 12 Feb 2025 Yamaha Motor posted a total of ¥50bn in one-off expenses for FY12/24. The profits for FY12/25 should rebound, thanks to non- Japan / Auto OEM recurring one-off expenses and the restructuring effects: NEUTRAL nevertheless, the level of profits is far from market expectations. In the short term, there are concerns that some of the core businesses Takaki Nakanishi may worsen. There are no major surprises in the medium-term +81 90-2212-8853 business plan, making it a weak catalyst for the share price to bounce nakanishi@astrisadvisory.com back.

4Q Results Flash: Negative

Japan Equity Strategy – PM Ishiba Earns His Keep

Neil Newman | 09 Feb 2025

Japan is likely the safest safe haven for investors in 2025 outside the US.

Japan appears more of a safe haven today than it has in years, following the first summit between Prime Minister Shigeru Ishiba and President Donald Trump. A trade spat was never seriously considered, but addressing trade imbalances was—and a relatively easy fix at that by snubbing Russian LNG imports. The dispute over Nippon Steel acquiring US Steel has been resolved, becoming 'investment’ in the US as promised. PM Ishiba will smoothe the way back home.

Deep Dive – The Final Front Ear – Japan in Space

Neil Newman | 08 Feb 2025

Episode II: Putting Things In Odd Places.

Disaster movies “Deep Impact” and “Armageddon” imagined it, but here comes the real thing, a large rock from the heavens that may hit us in seven years’ time. The US, Japan and China are developing defenses, the US has tested one, Japan and China plan to test theirs. All use kinetic energy to change the course of an asteroid. Japan’s precision landings on heavenly bodies, chasing space junk and new launch systems highlight potential new businesses for Japan’s space companies.

Internet Initiative Japan (3774)

Kirk Boodry | 07 Feb 2025

Q3 24 results flash: mixed

IIJ posted Q3 results that beat for revenue but missed at the OP line although EBITDA and net income were broadly in line. We consider this an encouraging quarter as operating profit (+9%) and EBITDA (+10%) grew at the highest rate since Q1 23, which puts full-year financial targets within reach whilst Q3 orders received rebounded strongly from Q2 and were the highest ever. We remain at Buy.

Subaru (7270 JP)

Takaki Nakanishi | 07 Feb 2025

The share price rose 9% after the announcement, following better-than- 07 Feb 2025 expected 3Q results and news of stronger shareholder return policies. Despite having a large amount of cash on hand, the company has Japan / Auto OEM continued to have overly cautious and vague shareholder return policies. BUY We highly commend CFO Mizuma for carrying out this reform as his final important task. We believe that SUBARU's environmental regulation risk Takaki Nakanishi is easing, hence we raised our rating to BUY on January 9th, citing stable +81 90-2212-8853 earnings and strengthened shareholder returns. nakanishi@astrisadvisory.com

3Q earnings flash: positive

Mazda Motor (7261 JP)

Takaki Nakanishi | 07 Feb 2025

Supplier compensation of over ¥5bn was included in 3Q (Oct-Dec) 7 Feb 2025 OP as a one-off factor which was one of the reasons for the shortfall in earnings. Sales in N. America remained strong, but the fierce Japan / Auto OEM competitive environment in each region did not bring about the NEUTRAL desired earnings growth. The comments included a prudent view for the next fiscal year. We think the results were in-line, with no Takaki Nakanishi surprises. +81 90-2212-8853 nakanishi@astrisadvisory.com

3Q Results Flash: In-line

LY Corp (4689)

Kirk Boodry | 06 Feb 2025

Q3 24 results flash: beat and surprise dividend raise

Solid eCommerce and fintech results have driven another quarterly beat and LY Corp is on track to exceed its full-year profitability targets with c. 80% progress to both EBITDA and EPS guidance already locked in. The company has mostly exceeded quarterly expectations since its operational nadir in 2023 but an increase in the dividend for the first time since the LINE/Yahoo merger and talk of further buybacks makes the recovery seem more real. We remain at Buy.

Suzuki (7269 JP)

Takaki Nakanishi | 06 Feb 2025

The 3Q results contained many positive elements. The much- 06 Feb 2025 anticipated new medium-term business plan is scheduled to be announced on February 20th. The company plans to build a growth Japan / Auto OEM strategy with a detailed financial strategy that is more conscious of BUY the cost of capital. Suzuki has shown its ambition to go into detail for the first time on capital efficiency, cash flow allocation, and Takaki Nakanishi shareholder return policy. We view this plan as an important driver of +81 90-2212-8853 the share price and regard it as an important thesis for our BUY rating. nakanishi@astrisadvisory.com

3Q Earnings Flash: Positive

Sky Perfect JSAT (9412)

Kirk Boodry | 05 Feb 2025

Q3 24 results flash: beat and raise

This was a great quarter. The company largely met or exceeded Q3 consensus and raised its full-year targets across the board. Expectations for FY24e EBITDA and net income have been raised by 4% and 6% respectively whilst a 23% increase in the dividend means shareholders benefit immediately. Management also laid out plans to drive mid- to long-term space revenue growth that make our current forecasts look conservative. We remain at Buy.

KDDI (9433)

Kirk Boodry | 05 Feb 2025

Q3 24 results flash: mixed quarter

KDDI posted mixed results with retail mobile sales predictably weaker than previous quarters but business service revenue also coming in light. The former was offset somewhat by stability in the roaming revenue stream coming out of Rakuten whilst the contribution from Lawson remained relatively robust despite expectations of seasonal easing. The company is largely on-track to meet its FY24e financial targets despite an OP miss this quarter, as it laps a tough Q4 last year.

Toyota Motor (7203 JP)

Takaki Nakanishi | 05 Feb 2025

The results were reassuring, with stable and extremely strong 05 Feb 2025 profitability maintained. One-off costs for the current fiscal year reached ¥520bn, and once these have run their course, stable results Japan / Auto OEM for the next fiscal year can be expected. Toyota is pursuing its own BUY SDV value chain and intends to accelerate the structural transformation from its existing one-time sale automobile business to Takaki Nakanishi a mobility business that makes money from recurring payments +81 90-2212-8853 throughout the entire vehicle life cycle. nakanishi@astrisadvisory.com

3Q Earnings Flash: Positive

Thoughts on the news that “Nissan withdraws the Merger MOU”

Takaki Nakanishi | 05 Feb 2025

negotiations for the merger are close to the end. We expect the details will be announced on the 13th of February. Nissan needs to Japan / Auto OEM fulfill its important responsibility of explaining the rationality of its independent turnaround plan. Honda needs to explain how it will Takaki Nakanishi build a new strategy to successfully implement its SDV strategy. +81 90-2212-8853 There are many uncertain factors for both companies, and it is nakanishi@astrisadvisory.com difficult to take clear investment action at this point, in our opinion.

Based on various media reports, the probability is increasing that the 5 February 2025

Sky Perfect JSAT (9412)

Kirk Boodry | 04 Feb 2025

Investment program continues apace

Sky Perfect JSAT has entered into a capital and business alliance with ArkEdge Space to help build and operate constellations of micro-satellites. Financial details were not disclosed but the investment falls under the ¥10bn investment allocation for space start-ups and venture funds that the company announced last year.

Softbank Group (9984)

Kirk Boodry | 03 Feb 2025

Support for generative AI in Japan too

Softbank Group rolled out the CEOs of ARM and OpenAI in a presentation to Japanese corporates on the launch if its new domestic Enterprise-focused generative AI service called Cristal. Its first customer will be the Softbank Group companies themselves, which have identified annual spending of up to ¥450bn ($3bn) over time. That aspect of the presentation was compelling enough to lift shares of Softbank Corp. and LY Corp into positive territory despite a terrible day for markets. There were also tentative signs of support for Softbank Group, although it has a bigger challenge in convincing investors that a massive OpenAI investment on a valuation 4x that of a year-ago makes sense. An OpenAI product reveal and a massive push into Japan do help. We remain at Buy.

Mitsubishi Motors (7211 JP)

Takaki Nakanishi | 03 Feb 2025

In addition to the expected harsh external environment, higher quality 3 Feb 2025 costs hit 2H earnings hard, resulting in a more severe profit plateau than expected. As for FY3/26 earnings, the company indicated an Japan / Auto OEM improvement thanks to a recovery in wholesales unit volumes and the NEUTRAL effect of new models. However, given the much lower than anticipated earnings in 2H, we believe that the risk of a large cut in the consensus Takaki Nakanishi for next fiscal year may be unavoidable. +81 90-2212-8853 nakanishi@astrisadvisory.com

3Q Results Flash: Negative

VIDEO: Visit to RoboDEX Robot show.

Neil Newman | 02 Feb 2025

RoboDEX 2025 Robot Trade Show in Tokyo

Neil Newman visited RoboDEX robot trade show in Tokyo and encountered Japanese humanoid robots.

Denso (6902 JP)

Takaki Nakanishi | 31 Jan 2025

The 3Q results had few surprises. Denso continued to change its business portfolio, strategically focus on growth areas. Although the Japan / Auto OEM company's view on the prudent outlook for FY3/26 is a concern, BUY there is no change to the mid-term growth story, in our opinion. Takaki Nakanishi

3Q Results Flash: In-Line

Aisin (7259 JP)

Takaki Nakanishi | 31 Jan 2025

The 3Q earnings were in-line with expectations, with no surprises. 31 Jan 2025 Quarterly OP has normalized for the first time in three years, and margins have recovered to 5%. Restructuring effects and a recovery Japan / Auto OEM in unit sales are driving the fundamentals, and the growth can BUY continue into FY3/26, in our view. The delay in the EV shift is improving the business potential of Aisin’s drivetrain business, as Takaki Nakanishi many OEMs are shifting to HEV/PHEV electric powertrains. This is an +81 90-2212-8853 important BUY thesis. nakanishi@astrisadvisory.com

3Q Results Flash: In-line

Japan Equity Strategy – Good Things Come In Threes

Neil Newman | 29 Jan 2025

Three things that may surprise in 2025

Last week at the British Chamber of Commerce in Japan's Shinnenkai, I gave a short speech and chose to steer away from conventional economic topics like the Bank of Japan's policy rate hike, the strengthening yen, or rising wages. Instead, I offered three bold predictions for 2025: Japan will enjoy a politically dull yet economically strong year despite global unpredictability; Japanese robots will perfect folding T-shirts, ushering in a new era for domestic assistance and disability aids; and Japan could lead in achieving nuclear fusion with a net energy gain, potentially integrating it into the energy mix by 2035.

Critical Minerals

Ian Roper | 24 Jan 2025

Metals should surprise to the upside in 2025 against poor expectations

Metals and Commodities Outlook: Metals like copper, zinc, and aluminum show strong potential for price increases in 2025 due to supply constraints and rising Chinese demand. Iron ore, nickel, and lithium markets are stabilizing, while thermal and metallurgical coal could recover driven by Indian steel growth. China and India in Trade: China diversifies away from U.S. dependency, expanding renewable energy and reducing oil imports. India faces challenges, including energy costs and decreased FDI, but economic growth and fiscal incentives may spark recovery in 2025. India’s Economic Recovery: Despite 2024 disappointments, India anticipates improved growth due to tax cuts, infrastructure spending, and controlled inflation. Key risks include global trade shifts and reliance on Russian energy.

NTT (9432)

Kirk Boodry | 23 Jan 2025

As expected, NTT Law to be amended not abolished

Press reports indicate the government will introduce legislation to the next Diet session to amend rather than abolish NTT Law. This has really been the only potential path as results from a Ministry of Industry Affairs and Communications (MIC, the regulator) review back in October recommended that key elements of the Law remain in place so it should come as no surprise. We are taking this opportunity to publish an update to our forecasts after Q2 results, although the changes our minor and our ¥207/share valuation by fiscal year-end is the same. We remain at Buy.

Japan Equity Strategy – Defence and Security 2025

Neil Newman | 22 Jan 2025

We are 25 miles from Russia, 70 miles from Taiwan, and 31 miles from Korea. Nervous?

We sit in the most heavily armed part of the world, with parts of Japan 25 miles from Russia, 70 miles from Taiwan, and 31 miles from the Korean Peninsula. The JSDF is undergoing an expensive transition costing 2% of GDP. Record tax collections in FY2024/25, and unrealised national assets, could fund more. The GCAP fighter plane project with the UK and Italy, planned for service in 2035, has taken an interesting turn. Japan is responsible for its stealth airframe design.

Softbank Group (9984)

Kirk Boodry | 22 Jan 2025

Masa has his mojo back

Softbank, alongside Oracle and OpenAI, has announced a $100-500bn project to build AI infrastructure in the US. The revelation of concrete plans for its expected $70bn+ AI pivot is good news for Softbank. Not only were ARM shares up 4% on the reveal, but we expect markets will start to build AI upside into their valuations now that we know where Softbank intends to go. We remain at Buy.

Softbank Group (9984)

Kirk Boodry | 17 Jan 2025

We are waiting for an AI pivot but TikTok comes first

Despite the apparent volatility in the share price, Softbank Group shares have essentially been range-bound for more than a year now when adjusted for NAV. Masa’s trip to Mar-a-Lago did not move the needle very much, although a positive resolution to the TikTok dilemma this weekend could unlock an eventual ByteDance IPO and boost NAV. Outside of that, updates on Softbank’s AI plans remain the focus. The company has been silent but press reports in December and January have filled in some of the gaps on what we might expect. Shares continue to look cheap at 50% of NAV and we remain at Buy.

Japan Equity Strategy - Humanoid Robots in Japan

Neil Newman | 15 Jan 2025

Perhaps the next big thing in home appliances starts to appear this year.

Humanoid robots are set to play a transformative role in society and economies and, with their own ChatGPT moment on the horizon, it is time to look at the players.

Japan Auto OEM/OE Supplier Sectors

Takaki Nakanishi | 08 Jan 2025

We reiterate our neutral stance on the OEMs and 10_Jan_ 2024 bullish stance on the OE suppliers, maintaining our preference order of (1) OE supplier > (2) OEM. We Japan / Auto OEM/OES believe that the OEM sector has reached a stage where the benefits of Trump 2.0 should be recognized over Takaki Nakanishi the disadvantages. We have raised Toyota to the top +81 90-2212-8853 pick in the sector and changed the order of preference nakanishi@astrisadvisory.com from (1) Suzuki > (2) Toyota > (3) Honda to (1) Toyota > (2) Suzuki > (3) SUBARU. Summary of Rating and Target Price Rating Target Price (¥) Expected

Investment Strategy for CY2025 and 3Q Earnings Preview

Japan Equity Strategy: T minus ten...and counting

Neil Newman | 07 Jan 2025

Ten days before MAGA re-starts. What could this mean for Japan?

It will be a turbulent year ahead. Several wars rage around the world, governments collapsing as a reinvigorated President Donald Trump returns. Mitigating rapidly changing risks in 2025 will challenge investors as the two largest economic rivals, the US and China, influence investment decisions. The next three largest economies—Germany, Japan, and India—all have depth and breadth in their stock markets. Japan appears positioned to outperform.

Japan Equity Strategy – It looked a bit like Christmas

Neil Newman | 30 Dec 2024

Japan has its own commercial style Christmas running up to New Year. And it feels like it may have been a good one.

Japanese spending picks up during seasonal festivities: Hanami picnics early in the year, summer holidays, trips to admire the autumn leaves, and a very commercial Christmas and New Year celebration.

Flash Note on Japan Auto OEM

Takaki Nakanishi | 23 Dec 2024

Honda and Nissan officially announce the start of merger talks We believe that Nissan has a chance to revive under a 23 Dec 2024 governance structure led by Honda. The merger represents a challenge to acquire future competitiveness and Japan / Auto OEM maximize corporate value for both companies. Honda will determine if Nissan can be a real partner that delivers the Takaki Nakanishi necessary changes to the alliance as an essential condition +81 90-2212-8853 for proceeding with the merger. Honda sees the nakanishi@astrisadvisory.com negotiations for merger as an opportunity to optimize its excess capital and has announced a share buyback of New Vehicle Sales ¥1.1tn (1bn shares, 23.7% of the total number of shares outstanding). There is a high probability that this will 000units 12,000 increase Honda's share price. 10,000 8,000 7,360

Flash Note on Japan Auto OEM

Softbank Group (9984), Buy

Kirk Boodry | 17 Dec 2024

Friends in high places

There has been a flurry of excitement over Masa Son’s trip to Mar-a-Lago to announce plans to invest $100bn and create 100K jobs over the next four years in AI and related infrastructure. There are strong parallels with 2016 when Masa made a similar trip and pledge ($50bn and 50K jobs). Masa has described Trump’s second electoral win as the double-down presidency and that he would double down too. Here we go.

Japan fintech tracker Q2 24

Kirk Boodry | 05 Dec 2024

Asset sales and restructuring are on the rise

There has been a flurry of corporate activity with Rakuten selling more fintech assets, KDDI restructuring its fintech JV with Mitsubishi UFJ, and DoCoMo reportedly leaning towards buy versus build to get into online banking. That has boosted shares of SBI Sumishin and Rakuten Bank although the real winner over the last month has been Monex Group.

Japan Equity Strategy - Where Do We Go From Here?

Neil Newman | 25 Nov 2024

The outlook for Japan's markets with Prime Minister Ishiba and President Trump

A minority government is in place, policies are tangled, and the LDP getting things done will be like waiting for a vending machine to accept a crumpled ¥1000 note. Meanwhile, across the Pacific, a reinvigorated Donald Trump is back to run the country; a lot will change, and much will get done very quickly. Japan might not change much, but in the U.S., who knows what’s coming? This could be a strong reason to be overweight equities in both countries.

Rakuten Group (4755), Buy

Kirk Boodry | 13 Nov 2024

Q3 24 results flash: beat

Rakuten Group posted Q3 results ahead of expectations and the first profitable quarter on an OP basis in the mobile era, driven largely by solid performance for fintech stalwarts Rakuten Card and Rakuten Bank. Headline mobile numbers look better too, but these have been adjusted for contributions from the mobile ecosystem and like-for-like performance came in exactly as expected.

Softbank Group (9984), Buy

Kirk Boodry | 12 Nov 2024

Q2 24 results flash: beat

Softbank Group posted Q2 financial results ahead of expectations powered by investment gains and a lower tax bill. There are a few key takeaways as Vision Fund upside was enough to push cumulative returns back into the black for the first time in nine quarters even as reported NAV on a yen basis was down QoQ on a weaker dollar.

Internet Initiative Japan (3774), Buy

Kirk Boodry | 08 Nov 2024

Q2 24 results flash: in-line

IIJ posted Q2 results that largely met consensus and Astris expectations. Revenue grew 12% in Q2, a fourth consecutive quarter for double-digit gains driven by one-time sales from system integration projects (+31%) but supported by recurring sales growth of 8% as corporate DX tailwinds continue to blow. We were particularly encouraged by cloud revenue growth of 9% with some of that benefit coming from VMWare repricing. Going forward, headline numbers should look more impressive as VMWare pricing pass-throughs drive gains in OP instead of losses. We remain at Buy.

Softbank Corp (9434), Buy

Kirk Boodry | 08 Nov 2024

Q2 24 results flash: beat and raise, but expected

Softbank Corp posted results modestly ahead of expectations partially fueled by the outperformance at LY Corp announced earlier this week. Similarly, management has raised its FY24e guidance, which now sits in line with consensus expectations. In the core mobile business, service revenue grew for the fourth consecutive quarter, helped by a return to net adds growth in Q2 and stable ARPUs. We believe the share price largely reflects the operational upside in mobile and the positive contribution from LY Corp. We remain at Neutral.

NTT (9432), Buy

Kirk Boodry | 07 Nov 2024

Q2 24 results flash: beat

After NTT Data’s shiny numbers yesterday, an earnings beat was already in the cards for NTT and it delivered that and a little bit extra. Q2 operating income of ¥484bn was ¥34bn higher than consensus forecasts as Data upside (of c. ¥17bn) was augmented by upside across the other business lines. DoCoMo’s topline was softer than we would have liked with service revenue erosion of 3% v 2% last quarter but NTT has described mobile improvement as an H2 story already so that weakness may already be baked into expectations. Looking ahead, we expect visible progress on issues that have held investors back such as concerns about regional business profitability and mobile weakness - and remain at Buy.

LY Corp (4689), Buy

Kirk Boodry | 05 Nov 2024

Q2 24 results flash: beat and guidance raise

LY Corp has posted another solid quarter driven by a beat in ad sales and robust EBITDA growth in the fintech business. The quarter was strong enough for management to raise its full-year targets for EBITDA and EPS to levels ahead of consensus and Astris forecasts, providing some confidence that the quarterly beat is sustainable. That should provide support for the shares to move higher and with 35% potential upside to our FY24e target price, we remain at Buy.

The Final Bell – Oct 2024 Japanese Market Review

Neil Newman | 05 Nov 2024

Ineffective New Management, same problem with the yen, no snow

The downfall of the hapless ruling Liberal Democratic Party was the highlight of October, the old guard badly punished by the electorate for losing touch with reality. Markets were positioned for political turbulence, though there was little follow through, equities underpinned, and everything continued in Japan’s micro-economic climate. Back to the same problem with yen, a further weakening raising the costs of imports and input costs to both companies and the home and back focus for MoF and BoJ.

KDDI (9433), Buy

Kirk Boodry | 01 Nov 2024

Q2 24 results flash: modest beat and buyback sweetener

This was a solid print with core businesses performing as expected and profitability modestly ahead of expectations. That the latter was helped by contributions from the Lawson investment is reassuring. Mobile revenue continued its recovery albeit with different drivers than we had forecast. Meanwhile, the company is buying back a record amount of shares for the second year running and will split its shares 2:1 by yearend. There is a lot to like in this report and we remain at Buy.

Sky Perfect JSAT (9412), Buy

Kirk Boodry | 01 Nov 2024

Q2 23 results reaction: in-line on space segment growth

Sky Perfect JSAT has posted Q2 results broadly in-line with consensus and Astris expectations, helped by continued robust performance in the satellite segment (revenue +9%, OP +29%). Media results were mixed with better revenue and less subscriber erosion than expected (37K net subs lost for Q2 23 v 67K a year ago) but a one-time ¥0.8bn charge on valuation losses impacting segment profit. Corresponding announcements on carbon neutral efforts and an expanded agreement on broadband resale with Starlink are encouraging and we remain at Buy.

Japan Equity Strategy – Greece is the way we are feeling

Neil Newman | 31 Oct 2024

Yet, Japan has no National Debt

Japan has the highest gross debt-to-GDP ratio of any country, and has been compared with Greece and the US by the ”one model fits all” debt-rating agencies. As interest rates rise, the cost of servicing debt goes up… or does it really, when most of government debt is owned by government pension funds and the central bank? Rumblings of a sovereign debt downgrade have started, but before anything like that happens, there needs to be a fresh look at Japan’s debt burden.

Aisin (7259 JP)

Takaki Nakanishi | 31 Oct 2024

2Q numbers below expectations, full-year guidance revised 31 Oct 2024 downward, and no changes in shareholder return plans all came together to cause the share price to fall by over 5% immediately Japan / Auto OEM after the announcement. 2Q results included over ¥10bn in one-off BUY factors, and the results are not that gloomy, in our view. The share price is likely to bounce back. The cancellation of the basic Takaki Nakanishi agreement to establish a joint venture with Mitsubishi Electric +81 90-2212-8853 Mobility and its replacement with a business partnership agreement nakanishi@astrisadvisory.com regarding the X-in-1 eAxles development was a surprise. Nevertheless, it is unlikely to make a substantial difference to the outcome and should lead to faster results, in our opinion. Valuation and Target Price

2Q Results Flash: In-line

Denso (6902 JP)

Takaki Nakanishi | 31 Oct 2024

We believe that the risk of a downward revision was already factored 31 Oct 2024 into the share price. The bold cut in the forecast should work as a catalyst to re-rate the stock. While Denso continues to make Japan / Auto OEM strategic investments, the announcement of a large-scale, long-term NEUTRAL share buyback facilitates its continued improvement of capital efficiency, which demonstrates the strength of the company's Takaki Nakanishi financial discipline. This supports our BUY investment thesis. +81 90-2212-8853 nakanishi@astrisadvisory.com

2Q Results Flash: In-line

Mitsubishi Motors (7211 JP)

Takaki Nakanishi | 30 Oct 2024

Although there were no surprises, 2Q results showed steady 30 Oct 2024 improvement from the weak 1Q. We rate the overall results as in-line, but there may be a positive stock price reaction in the short term. Over Japan / Auto OEM the next six months or so we expect to see some progress in important NEUTRAL management issues such as the development of alliances and shareholder return measures. From the long-term perspective, there Takaki Nakanishi are still many fundamental issues to be addressed, but we believe that +81 90-2212-8853 trading opportunities exist for which we are in a phase of identifying the nakanishi@astrisadvisory.com appropriate timing.

2Q Results Flash: In-line

NTT (9432), Buy

Kirk Boodry | 29 Oct 2024

Potential AI auto venture with Toyota highlights tech credentials

The Nikkei has reported that NTT and Toyota will soon announce a ¥500b joint venture to develop AI-based driver support software. The JV will take Toyota’s Software Defined Vehicle (SDV) concept and combine it with NTT’s AI and communications infrastructure to create a competitive alternative to the self-driving software options already being tested.

Softbank Group (9984), Buy

Kirk Boodry | 23 Oct 2024

AI news including ARM and Apollo

It has been a surprisingly busy day for Softbank Group as reports of potential AI investment continue to filter through even as ARM escalates its feud with Qualcomm over licensing agreements. On balance, markets were slightly negative on the news as shares fell 0.5%. Despite the announcement of a share buyback at the Q1 results, the discount to NAV remains stubbornly above 50% as markets give less credit to the impact of a stronger dollar (+2% over one week and +6% over one month) on asset valuations. We remain at Buy.

NTT Law update

Kirk Boodry | 21 Oct 2024

NTT Law update: Regulator working groups happy with status quo

Results from the Ministry of Internal Affairs and Communications (MIC, the regulator) working groups (WG) are coming out now, and unsurprisingly, there is very little that the regulator believes should change although in most cases the WGs have signaled flexibility should conditions evolve. We expect WG suggestions will be factored into the telecom business law and, possibly, other regulations as needed, opening the door for the LDP to propose the abolition of the NTT Law when the legislature meets next year.

Honda Motor (7267 JP)

Takaki Nakanishi | 09 Oct 2024