Our Events Join us in person or virtually at key industry gatherings!

UPCOMING EVENTS

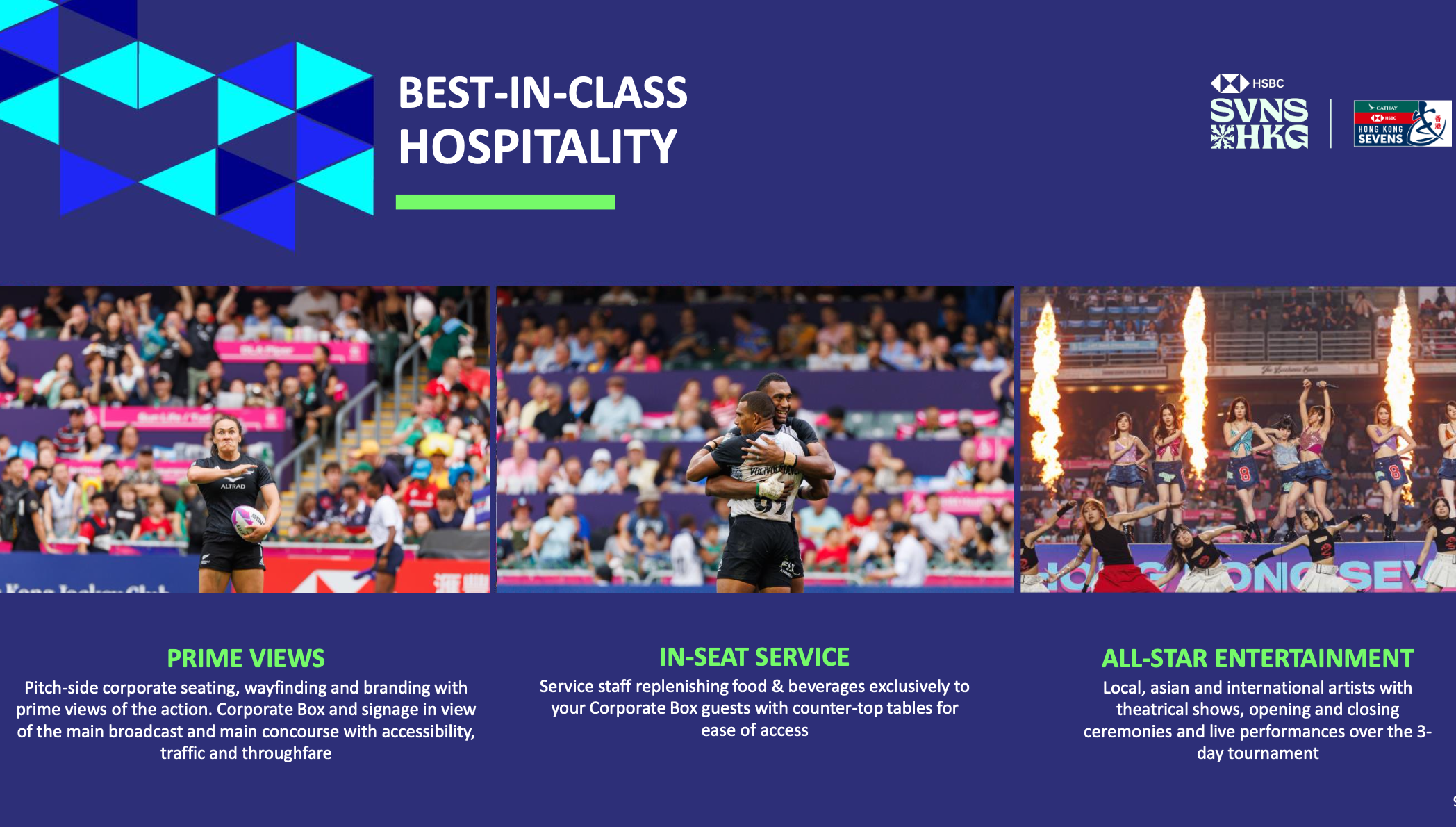

Hong Kong Sevens 2025

The premier rugby sevens tournament in Asia, featuring top international teams competing in a three-day festival of sport and entertainment.

BCCJ Global Forecast 2025

Astris Advisory Japan is delighted to share the stage with Barclays at the BCCJ Global Forecast 2025 on April 8th. Neil Newman, Head of Strategy at Astris Advisory, will join Andrew McDougall, Global Head of Geopolitical Risk at Barclays, to discuss the key geopolitical and economic trends shaping the year ahead, moderated by Heather Prosser.

How “Making America Great Again” Is Reshaping Japan and Emerging Asia

Astris Advisory: London Seminar Lunch, Thursday 24th July 2025

Join us for an in-depth look at the drivers shaping Asia-Pacific markets. • Interest in commodities, and China more broadly, is at extreme lows, even worse than in 2015, causing the market to overlook major developments, particularly in the green economy. • While India benefits from lower energy prices and remains a compelling long-term metals story, the real shift is in coal's decline as renewables gain traction in China, India, and Korea, raising questions about China’s next five-year plan and exposing Europe’s grid and storage challenges. • Outlook for the Japanese equity market: we’ll explore the macro-thematic sectors driving performance; investor patterns, FOREX and rates, identify where capital is flowing, highlighting the most promising long and short opportunities for the second half – introducing the Astris Advisory Short Report.

Analyst Profiles

Neil Newman

Neil is an expert commentator and seasoned strategist on Japanese and pan-Asia equities markets drawing on his 40-years experience in Japan and Hong Kong. His publications include: Equity macro thematic and macroeconomic strategy notes equity market outlook multimedia articles a quarterly deeper dive into emerging or existing themes video interviews with interesting guests round table participation in discussions with industry experts videos of interesting events and trade shows. Office visits - Europe, the US, and Asia regularly to discuss the latest on Japan with presentations to small internal groups, managers, and external clients.

Read full profile

Takaki Nakanishi

Takaki Nakanishi has over 30 years of unique and broad experience in the auto industry, uninterrupted since 1994. Nakanishi ranked 1st in the Institutional Investor “All-Japan Research Team Rankings” for the auto sector for six years running from 2004 to 2009. He also ranked No.2 in 2012 and No. 1 in 2013 after spending time in asset management.

Read full profile

Michael Brodie Brown

Michael has 15 years of experience in sell-side quantitative and fundamental research roles, he focuses on building value-added quantitative models.

Read full profile

Ian Roper

Ian Roper is a highly regarded commodity strategist, with over 22 years of experience in metals based in London, Shanghai, Singapore, and now Tokyo. He brings his leading-edge thoughts on the markets as an unbiased independent analyst.

Read full profile